CLIENT

PROJECT

MORTGAGE HUB

SUMMARY

This is the journey of transforming Mortgage Hub from a fragmented, inefficient process into an intuitive platform that unites borrowers, brokers, and lenders. As the Design Lead, I reimagined the underwriter experience, streamlined workflows, and introduced features that enhanced communication and efficiency at every step.

RESPONSIBILITIES

UX Design Lead

BUILDING THE MISSING LINK IN MORTGAGE ORIGINATION

Mortgage Hub aimed to revolutionize this process with a unified platform. When I joined the project, the broker side of the platform was already designed and tested. Still, there was no corresponding solution for underwriters – nor a seamless connection between the two sides. Building the underwriter platform from the ground up and bridging this gap became the focus of my work. Through discovery, testing, and iterative design, I developed a system that enabled real-time collaboration and streamlined the mortgage journey for all parties involved.

The result? The platform reduced the time it takes to secure a mortgage from over a month to under seven days, transforming the experience for borrowers, brokers, and lenders alike.

THE PROBLEM

A FRUSTRATING PROCESS

The mortgage origination process in the UK was plagued with inefficiencies that left borrowers frustrated and brokers and underwriters overwhelmed. Borrowers lacked transparency into their loan progress, while brokers and underwriters relied on outdated tools and manual processes that caused delays and increased the risk of errors.

Communication was fragmented, with brokers and underwriters relying heavily on emails and phone calls, making collaboration slow and prone to missteps. The underwriter’s workflow, in particular, was hindered by a lack of tools for managing borrower details, reviewing documents, and tracking case statuses in one place. These challenges created a critical need for a platform connecting all stakeholders and streamline the process.

THE VISION

CLARITY, SIMPLICITY & CONNECTION

When I joined the project, our goal wasn’t just to build a lender side of the platform. It was to build a bridge – a seamless connection between borrowers, brokers, and underwriters. The mission was ambitious but necessary:

Empower borrowers with real-time application visibility.

Support brokers with streamlined communication.

Equip underwriters with tools that reduce friction and improve focus.

We envisioned Mortgage Hub as the answer to years of inefficiency – a platform that would transform chaos into clarity.

THE PROCESS

LISTENING TO THE VOICES THAT MATTER

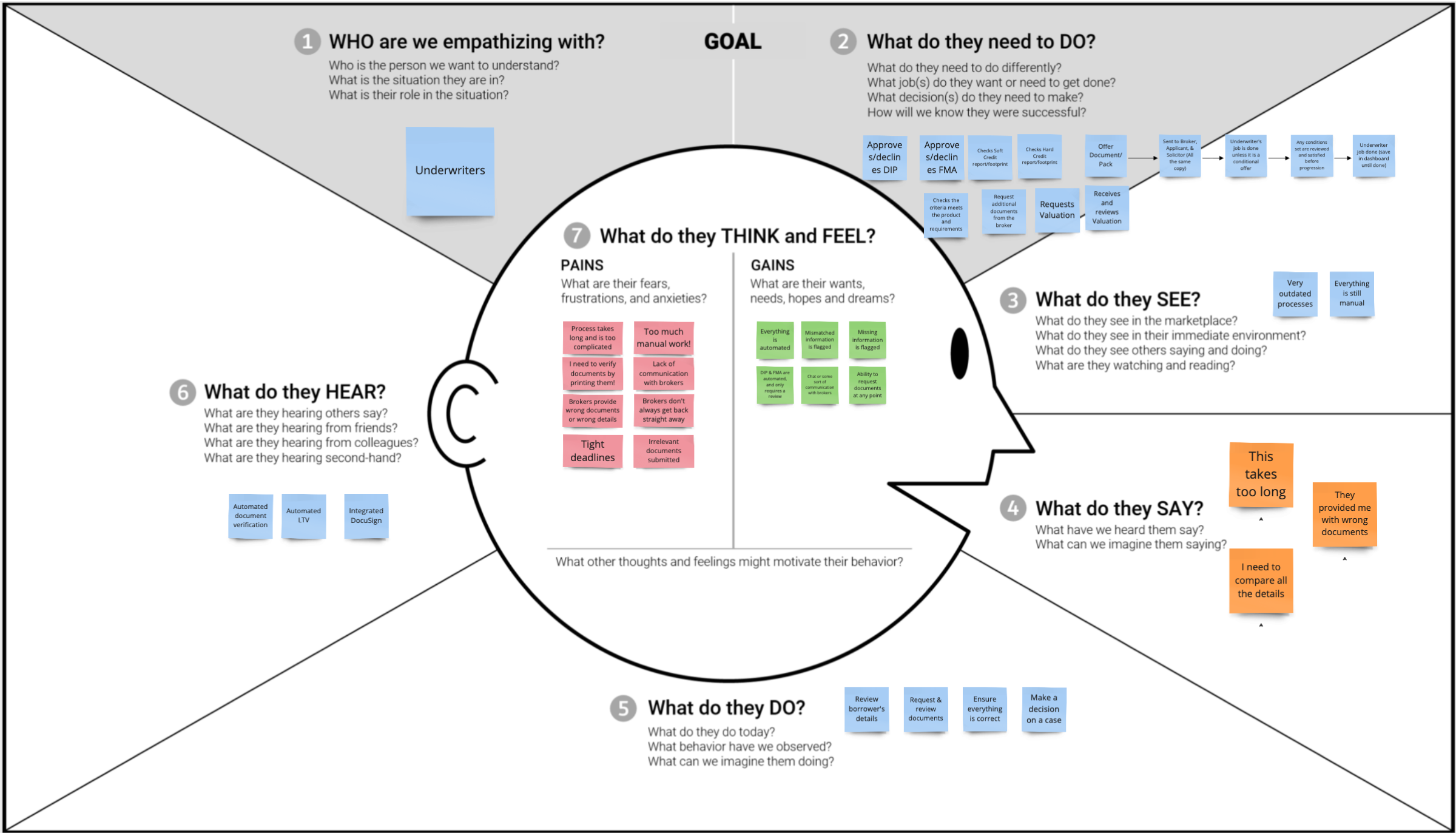

Every journey starts with understanding the roadblocks. I facilitated workshops with underwriters to uncover the pain points, delving deep into their day-to-day challenges.

A WHODO exercise revealed the complex ecosystem under the umbrella of "lender."

Through empathy mapping, we pinpointed their pain points:

Juggling multiple tabs and printed documents.

A lack of tools for clear and efficient decision-making.

Over-reliance on outdated processes is prone to errors.

We didn’t stop at frustrations. Through these sessions, we identified opportunities – ways to simplify workflows, reduce friction, and create value.

From these insights, I defined three actionable problem statements, each representing a pivotal area for improvement.

SIMPLIFYING COMPLEX WORKFLOWS

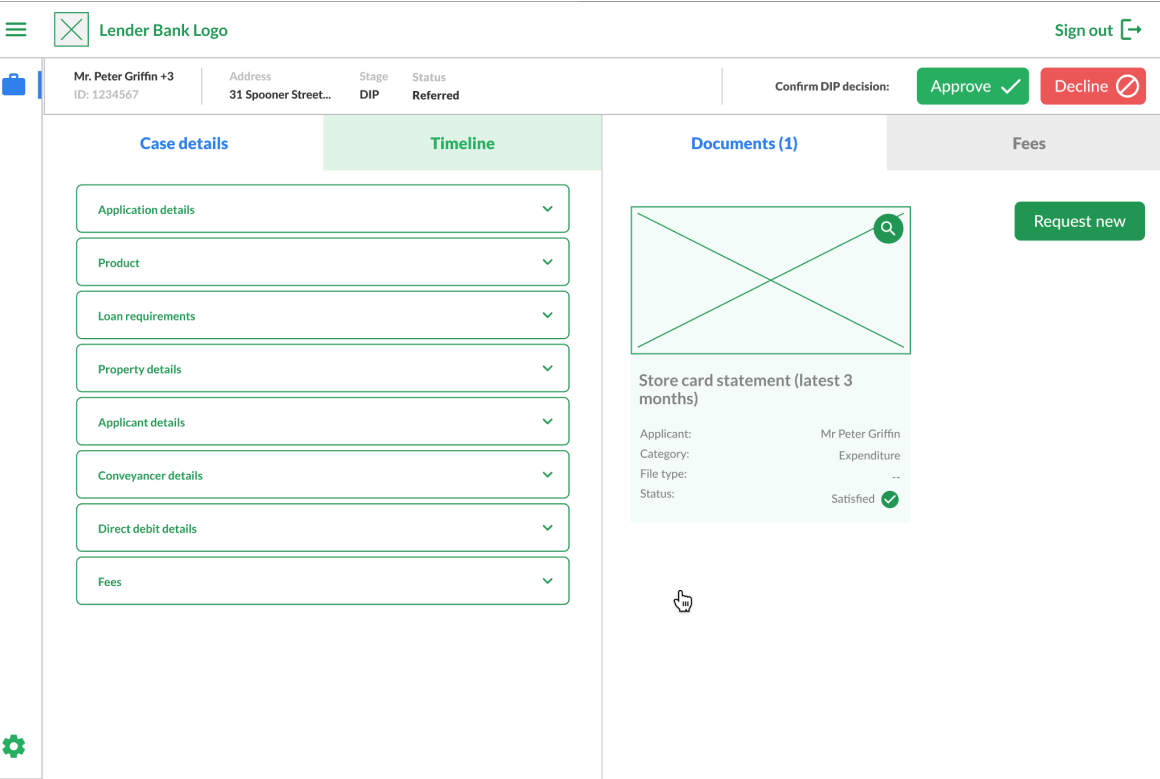

To bring clarity to underwriters' tasks, I redesigned the platform with structure at its core. The result? A two-column interface:

Left Column: A reference space for borrower information provided by brokers—items needing review but no immediate action.

Right Column: An action hub where tasks like document review, underwriting decisions, and note-taking took precedence.

This clear separation meant underwriters always knew where to look and what to do next.

ELIMINATING MANUAL FRUSTRATIONS

Underwriters shared a common grievance: the inability to compare borrower details and documents without printing them or toggling endlessly between tabs.

The Solution: I introduced a side-by-side document viewer, allowing users to view borrower details and documents simultaneously.

The Impact: Usability testing revealed this feature dramatically reduced errors, improved accuracy, and sped up decision-making – earning enthusiastic praise from underwriters.

CONNECTING BROKERS & UNDERWRITERS IN REAL-TIME

Communication delays and outdated information often hindered collaboration between brokers and underwriters. My challenge was to make this interaction fluid and intuitive.

The Solution: A system of real-time updates and shared case notes kept both brokers and underwriters on the same page.

The Result: No more miscommunication and unnecessary back-and-forth – just streamlined collaboration.

THE RESULT

A NEW WAY OF WORKING

When we tested the platform with underwriters, something shifted. They didn’t just like the new tools – they relied on them. Processes that once took hours were completed in minutes. Mistakes caused by manual work plummeted. And the clarity of the interface meant fewer questions and smoother workflows.

Mortgage Hub wasn’t just a tool anymore – it was their ally.

THE FUTURE

WHAT’S NEXT FOR THE MORTGAGE HUB?

With the MVP fully developed, Mortgage Hub is ready to revolutionize the mortgage industry. While rising UK mortgage rates delayed the initial launch, the team was in talks with several lenders and planned to go live by the end of 2023, when I left the project.

The journey has only begun, but the goal remains: to bring clarity, speed, and collaboration to a broken system and simplify home ownership for everyone involved.

KEY INSIGHTS

EMPATHY, EFFICIENCY & COLLABORATION

Understanding User Needs Through Workshops: By facilitating empathy mapping sessions and workshops with underwriters, I was able to gain a deeper understanding of their pain points. This informed the design direction and helped me identify opportunities to streamline workflows.

Prioritizing Efficiency: It became clear that underwriters needed a platform that reduced the manual handling of documents and information. My focus shifted to creating a design that minimized the need for switching between tabs and tools, centralizing everything in one intuitive interface.

Simplifying Decision-Making: The lack of clear decision-making tools was a significant challenge. I identified this gap and worked to integrate features that would allow underwriters to make faster, more accurate decisions – based on all relevant data in one place.

Bridging the Broker-Underwriter Gap: The absence of a connection between the broker and underwriter platforms was a key issue. I knew that creating a seamless flow of information between these two parties would be crucial for improving communication and reducing delays.

FINAL THOUGHTS

TRANSFORMING THE PROCESS

The Mortgage Hub project was more than a design challenge – it was an opportunity to address systemic inefficiencies in the mortgage origination process. By actively listening to users and prioritizing their needs, we built a platform that not only resolves pain points but also sets a new standard for clarity, efficiency, and collaboration in the UK mortgage sector.

This project reinforced the importance of combining user-centric design with iterative validation. Every decision – simplifying workflows, automating tasks, or improving communication – stemmed from real-world insights gathered during discovery.